city of richmond property tax calculator

Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond. You can call the City of Richmond Tax Assessors Office for assistance at 804-646-5600.

815 am to 500 pm Monday to Friday.

. June 5 and Dec. This property tax calculator is intended for approximation purposes only. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes.

Broad Street Richmond VA 23219. Please note that we can only estimate your property tax based on median property taxes in your area. Object Moved This document may be found here.

Richmond Property Tax Calculator. Real property tax on median home. City of Richmond Assessor City of Richmond Assessor.

1000 x 120 tax rate 1200 real estate tax. 295 with a minimum of 100. Search property by name address parcel ID.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. By Richmond City Council. Get Record Information From 2021 About Any City Property.

For example entering W0210213 will display the. Penticton Property Tax 2021 Calculator Rates Wowaca. Additional fees may apply.

Tangible personal property is the property of individuals and businesses in the city of richmond. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Personal Property Taxes are billed once a year with a December 5 th due date.

If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access Richmond Hill at 905-771-8949. Real Estate and Personal Property Taxes Online Payment. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. If you have documents to send you can fax them to the City of Richmond assessors office at 804-646-5686. Restaurants In Erie County Lawsuit.

3 Road Richmond British Columbia V6Y 2C1 Hours. Personal Property Registration Form An ANNUAL. 900 East Broad Street Room 802.

Please call the assessors office in Richmond before you send. If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000. The following video provides a simplified explanation of the relationship between your assessment value and your property taxes.

Opry Mills Breakfast Restaurants. Restaurants In Matthews Nc That Deliver. City of richmond property tax inquiry.

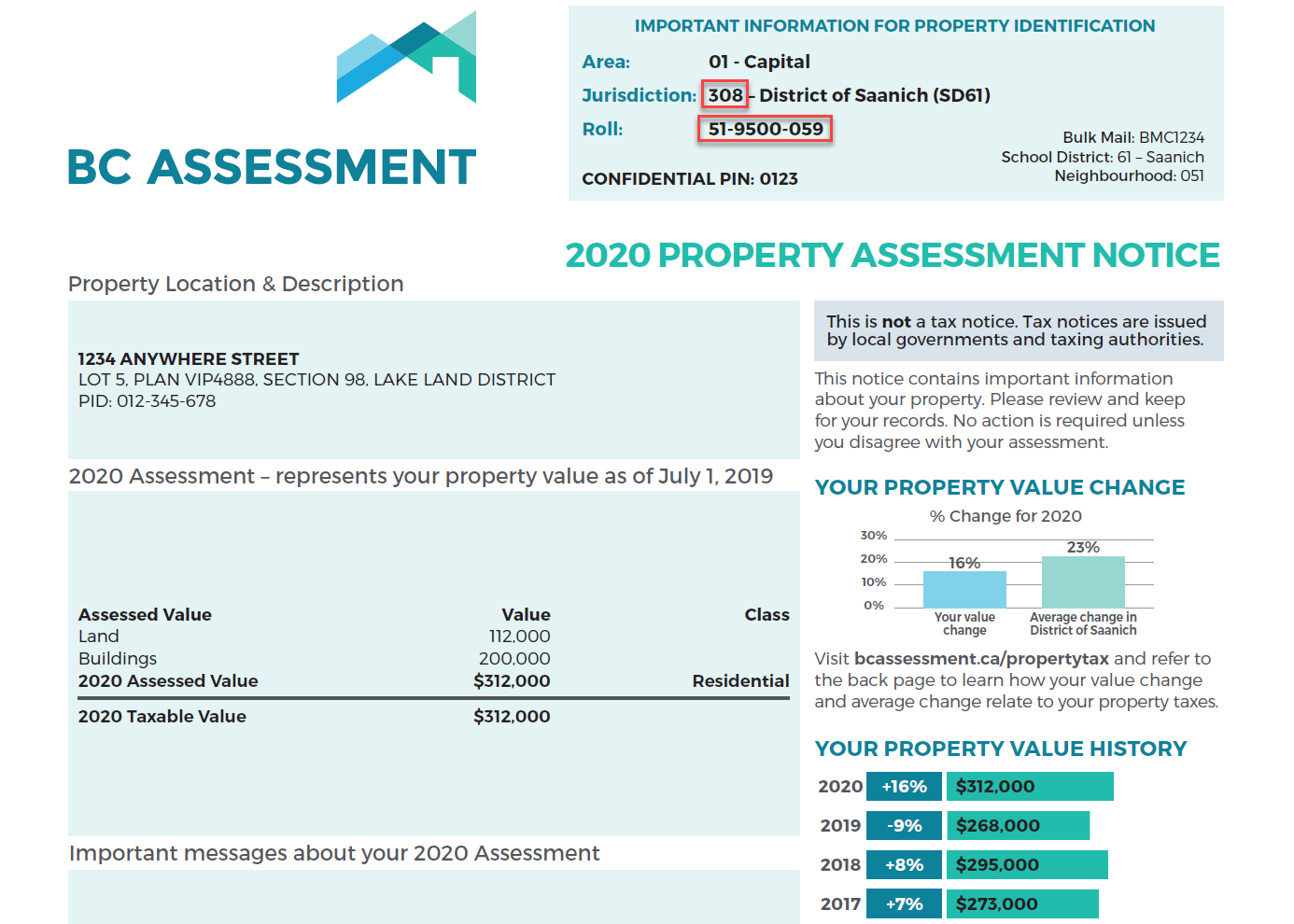

Property value 100000. Property taxes are calculated based on the assessment values set by BC Assessment. Under the state Code reexaminations must occur at least once within a three-year timeframe.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. The propertys Parcel ID should be entered such as W0210213002. The Richmond Rent Program requires all Landlords maintain an up to date business license for each rental property they operate within the City of Richmond.

Ad Searching Up-To-Date Property Records By City Just Got Easier. Remember to have your propertys Tax ID Number or Parcel Number available when you call. We accept cash personal check cashiers check and money order.

Are Dental Implants Tax Deductible In Ireland. 072 2015 not set as of 3315 Chesterfield County. Usually new assessments use an en masse strategy applied to all alike property in the same locality without individual property tours.

This information pertains to tax rates for Richmond VA and surrounding Counties. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. Sales Tax State Local Sales Tax on Food.

Census Bureau American Community Survey 2006-2010. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Municipal Finance Authority 250-383-1181 Victoria Property Assessments.

Electronic Check ACHEFT 095. Charles City County 804 652-2161. City of Richmond adopted a tax rate City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456 Website Design by Granicus - Connecting People and Government.

Property Tax Appraisals The City of Richmond Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property. Property Value 100 1000. Use the search tab to add properties to your selection list.

These documents are provided in Adobe Acrobat PDF format for printing. To pay your 2019 or newer property taxes online visit the Ray County Collectors websiteAll City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the Ray. June 5 and Dec.

A 10 yearly tax hike is the maximum raise allowed on the capped properties. Tax Rate per 100 of assessed value Albemarle County 434 296-5856. View your tax bill.

City of Richmond Parcel Tax Search. The basic rate for each business each location annually is 23810 per APN parcel. Majestic Life Church Service Times.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established. The City Assessor determines the FMV of over 70000 real property parcels each year.

Search by Property Address Search property based on street address. Monday - Friday 8am - 5pm. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate the auto suggestion.

Search by Parcel IDMap Reference Number.

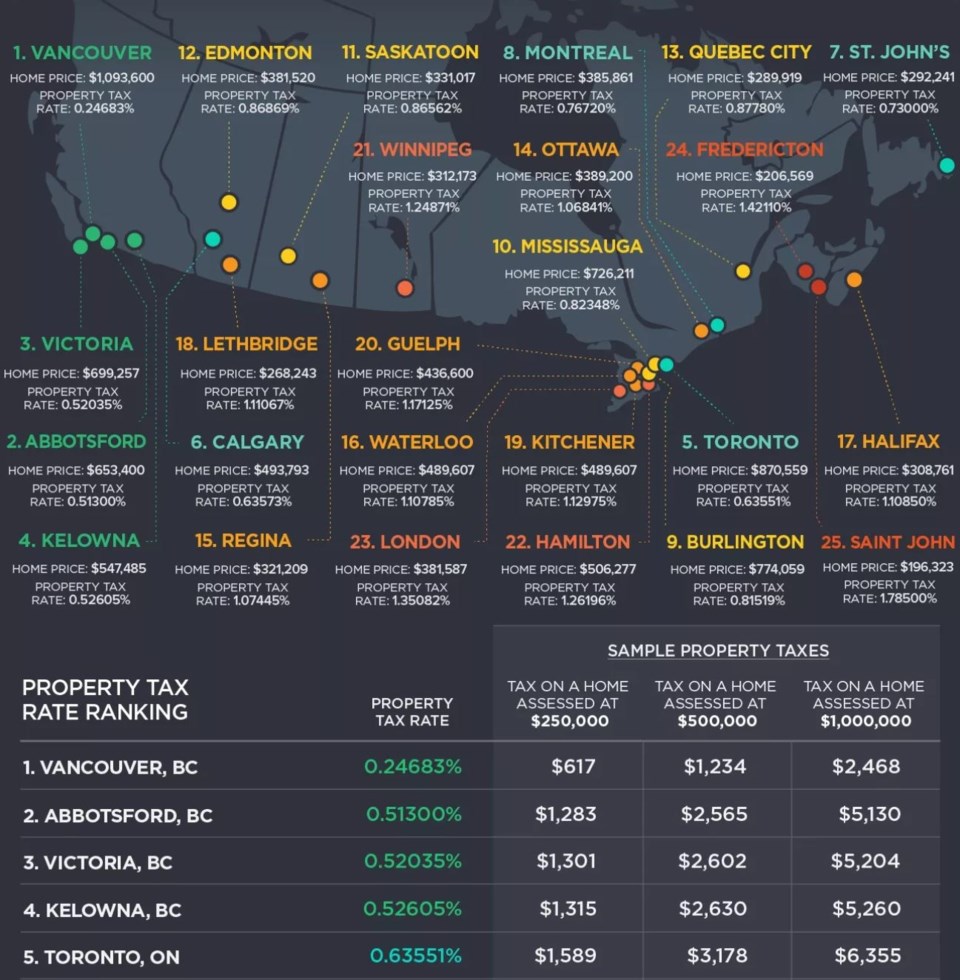

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

Toronto Property Tax 2021 Calculator Rates Wowa Ca

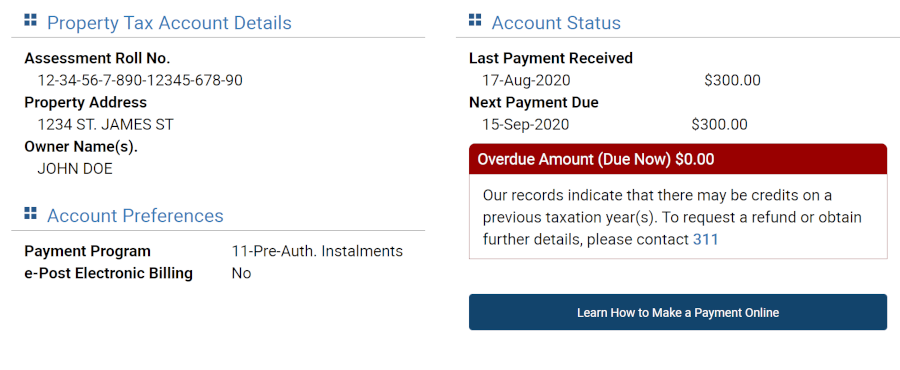

About Your Tax Bill City Of Richmond Hill

Average Residential Tax Bill Amount

Richmond Property Tax 2021 Calculator Rates Wowa Ca

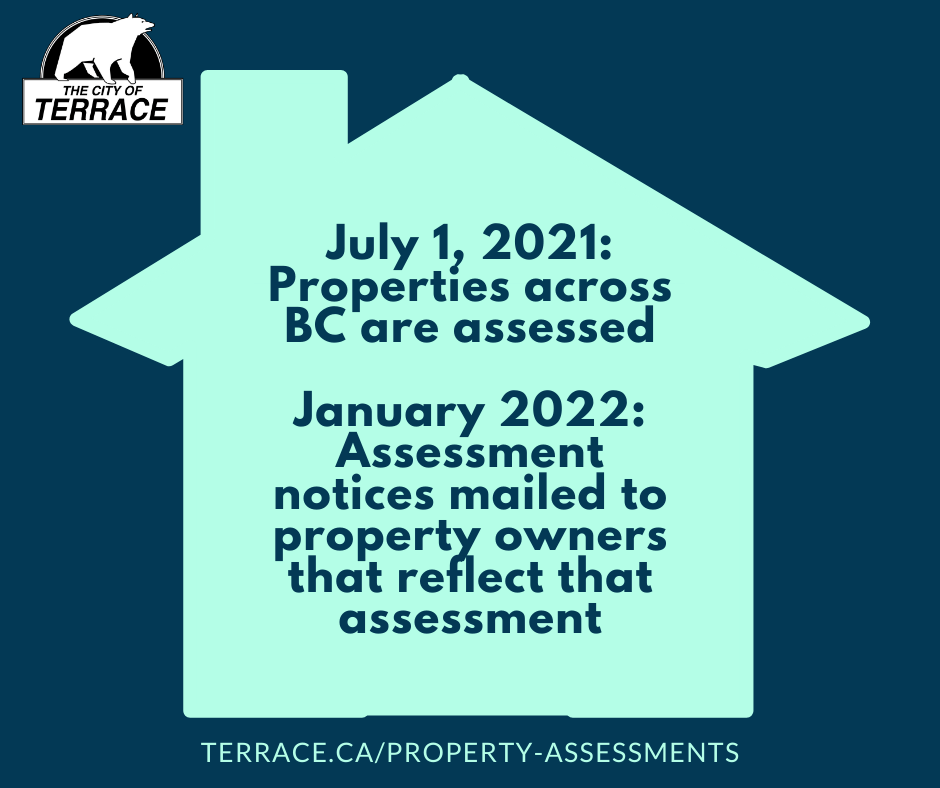

Northern Bc Region Property Assessments

3570 Strandherd Drive Unit 8 Nepean Ontario K2j5l4 Ottawa Ontario Waterfront Property Toronto Ontario

Paradym Fusion Viewer Home Buying Real Estate Kaizen

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Ontario

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

Property Assessments City Of Mission

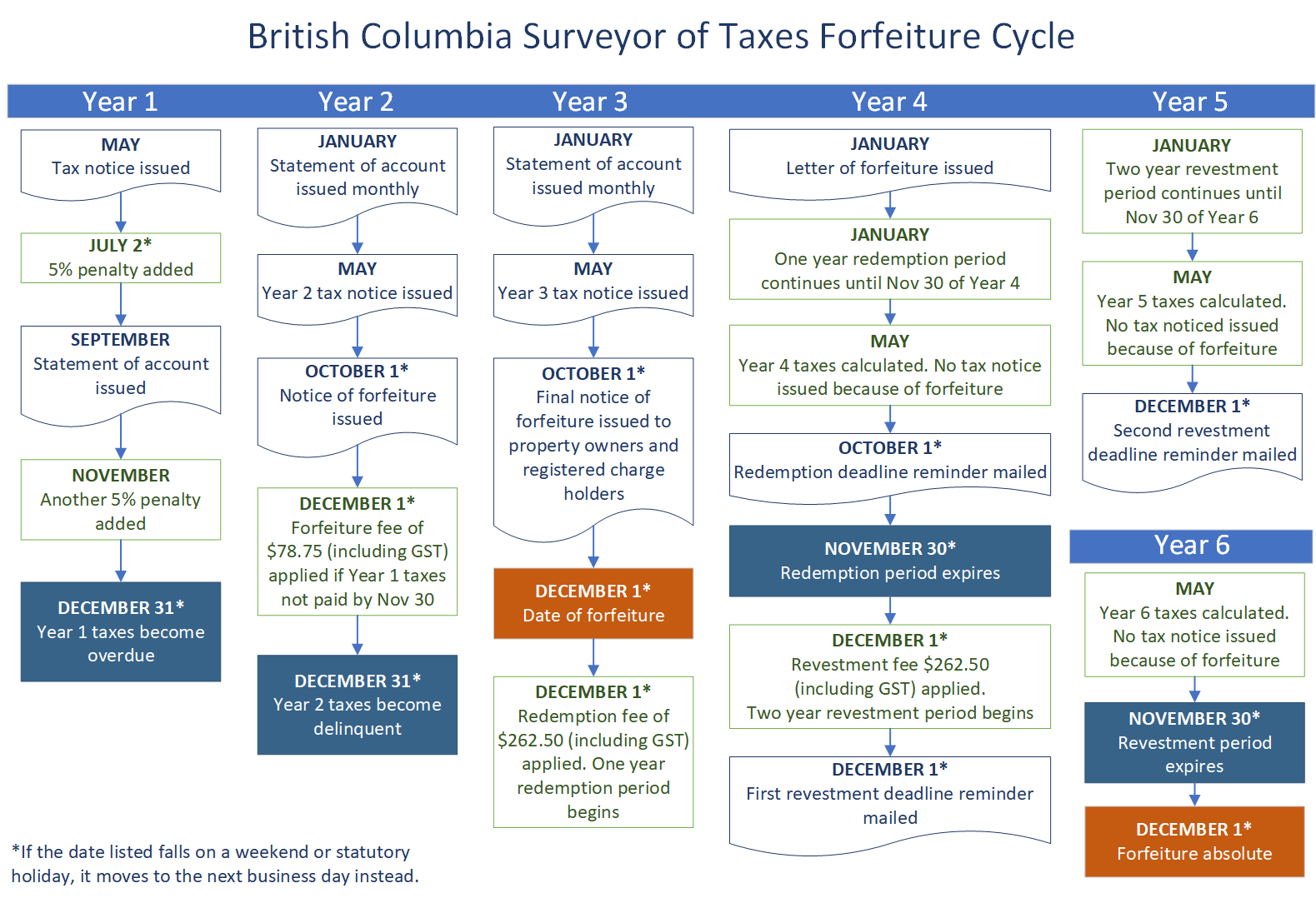

Overdue Rural Property Taxes Province Of British Columbia

Property Assessments City Of Terrace

Toronto Property Taxes Explained Canadian Real Estate Wealth

New York Buyer Picks Up Northside Apartments Richmond Bizsense Apartment Projects Local Real Estate Commercial Real Estate

Property Assessment Assessment Search Service Frequently Asked Questions